E TIN Certificate Download by NID Number

TIN Certificate is available with a few taps of finger. You can download your E TIN Certificate by your NID number and mobile number only.

Do you Need a TIN Certificate? Here is how to download e TIN certificate by NID Number and detailed information about TIN Registration Online in Bangladesh.

You can also know the benefits or disadvantages of the TIN certificate. Let’s know more about TIN Certificate Download Bangladesh.

What is E TIN Certificate in Bangladesh (e TIN BD)

TIN’s full meaning is Tax Identification Number. TIN (Tax Identification Number) Certificate tells that you are a proud taxpayer of the country. You have a tax identification number.

A 10-digit TIN number is your identification number as a taxpayer with which you can be identified. In addition, various financial institutions can verify the TIN certificate with this TIN Number.

Of these 10 digits, the first numbers refer to the taxpayer’s tax region, the middle three numbers refer to the rank and the remaining four numbers refer to the taxpayer’s identity.

Having a TIN Certificate doesn’t mean you have to pay taxes. You have to pay the tax only when you have taxable income (over 3,00,000 for men and 3,50,000 for women and people over 65)

At present, you do not have to visit the income tax office to get a TIN certificate. You can complete your e-tin registration online with your mobile number and national identity card (NID Card).

If you do not have NID yet, you can download NID Card Online Copy or apply for a new National Identity Card online.

Why TIN Certificate is Required

Not just for business or job, in different cases, you must get a TIN certificate compulsorily.

- Take a trade license to start a business

- To own a car

- To register any land, flat or building in the City Corporation area

- Get a credit card

- To buy savings certificates

- To buy shares of any company

- To register your own company

- Take a license to import any product

- Freelance professionals such as accountants

- To practice the profession of lawyers, doctors, engineers

- To be a candidate in the election

- To be a member of a business association or a registered organization

- To participate in tenders of government, semi-government, and autonomous organizations

- To give cars to ride-sharing companies

In the above case even if your income is not taxable, you will compulsorily need a TIN certificate.

Let’s know how to download TIN certificate by NID number. You can create and download e TIN certificate by filling out the online TIN Registration form at home.

TIN Certificate Download by NID Number | TIN Certificate Online Print

To download TIN certificate by NID number, visit secure.incometax.gov.bd/Registration. Complete registration and mobile OTP verification. Then click TIN Application menu and apply for e TIN registration with all the required information. After successful registration, you can download TIN certificate.

Moreover, if you have the previous tin, you can also download TIN certificate by TIN number

Follow the steps below to register for e-TIN online.

Step 1- Account registration

To do TIN visit- secure.incometax.gov.bd

This is NBR’s e-TIN registration website. Click on the Register button from the menu.

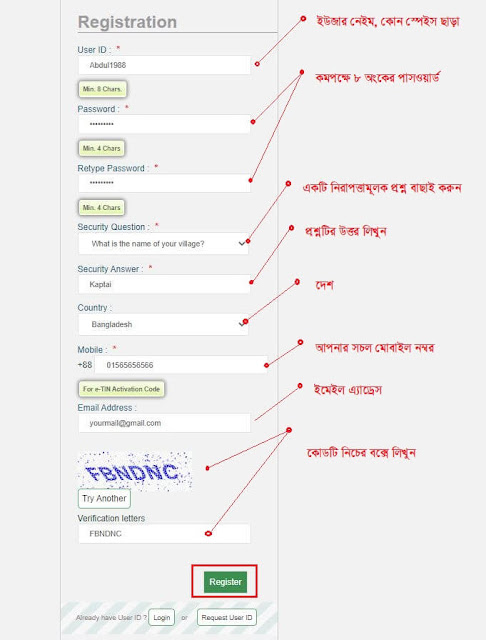

You’ll find the following page. Now fill the form correctly as shown in the picture below.

First, you need to create an account on the e-TIN website. The account will be used in the future to change your tax region, change the address or modify the TIN certificate.

So, you have to remember the username and password of the account or write it down in a notebook.

You can give the username in a mixture of names and numbers to keep it unique.

For mobile verification, an Activation Code will be sent to your mobile. This will be required to activate the account.

Then write the captcha letters you see in the image. Here, we can see FBNDNC on the image. So write the exact in verification letters.

After completing the form correctly, click on the Register button.

Step 2 – Activation Code Verification

Then a 6-digit Activation Code will be sent to your given mobile number. Activate your account with the code.

Step 3 – Fill out the TIN Certificate Registration Form

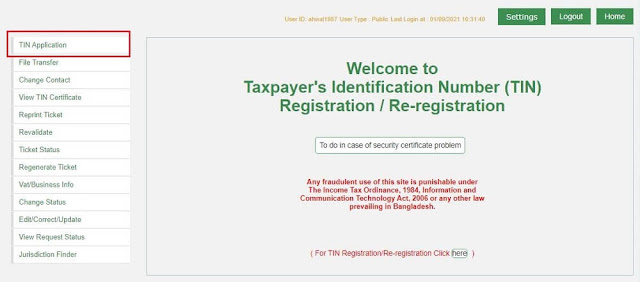

Once the account is activated, log in again.

After logging in, you will see a page like the above. From the top left here, click on the Tin Application option.

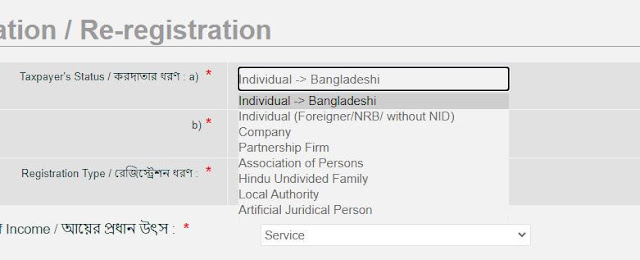

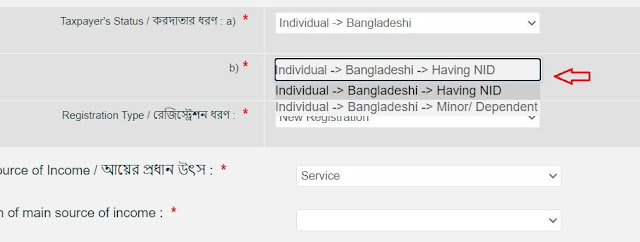

Choose the Taxpayer’s Status here. If you are a citizen of Bangladesh, select Individual Bangladeshi in the a) option. In other cases choose an option according to your type.

From option b), if you are above 18 years of age and have a national identity card, select the Having NID option. If you are under 18, choose the Minor / Dependent option.

Then you have to choose the main source of income. In the case of employees, choose Service, Professionals such as Doctors, Engineers, Chartered Accountants, etc., Profession, Business.

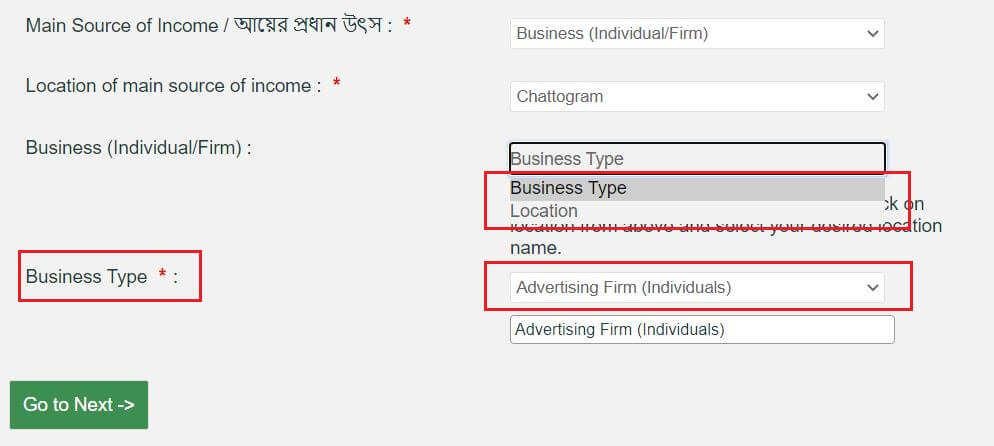

Then choose your job, occupation or business type. I have given Business (Individual / Firm) as the main source of income here. I have selected Chattogram as my business location.

If you do not find the type of business or profession in the Business Type or Profession Type option, choose Business Location. In the case of Location, select the area according to the location of your business.

Then go to the next step by clicking the Go to Next button below.

Personal information and address

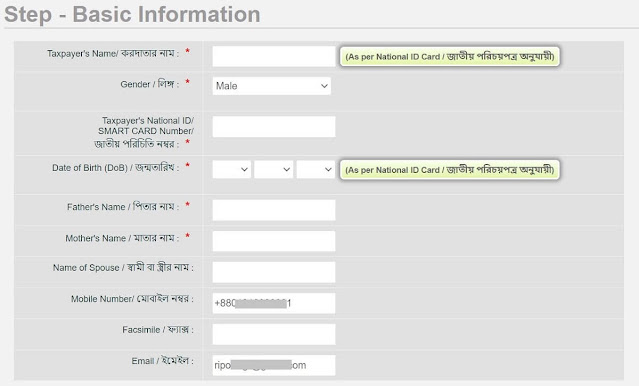

Your personal information and address will be requested on the next page. Be sure to fill in the information in English.

Your name, National Identity Card number (16 digits) or Smart Card number (10 digits) and date of birth must be in accordance with the national identity card.

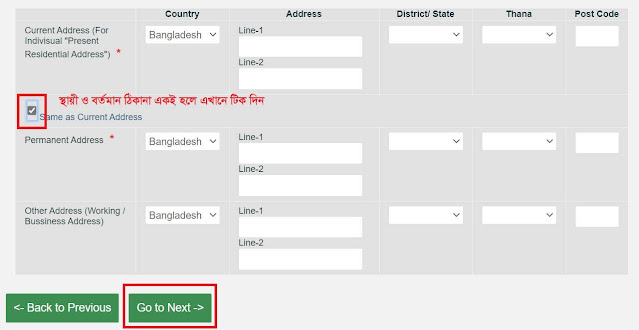

Enter your current and permanent address in English at the bottom.

After entering the address, click the Go to Next button.

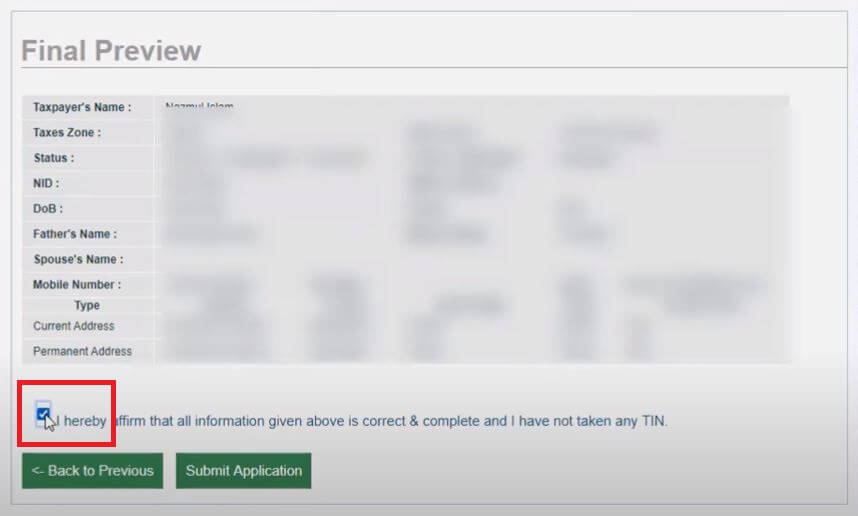

Step 4- Download E TIN Certificate

Here all the information will be shown by verifying the information given by you according to your NID or Smart Card.

Tick to confirm that all your information is correct and complete. Then click the Submit Application button.

Your TIN certificate will be created and you will be shown all the information about TIN registration. You can download the E TIN Certificate PDF file from the next page by clicking View Certificate and then the Save Certificate button.

If you need a TIN certificate online print copy, print out the pdf file with a color printer. You can laminate it for safety.

TIN Certificate Download by TIN Number

TIN Certificate download by TIN Number is not possible directly. That means you can’t download your TIN certificate with the only TIN number. You need the mobile number used for e-TIN registration. When you have the mobile number, you can recover the lost TIN certificate.

If you are 18 years old, have a national identity card, and have an income, you can get your e-Tin certificate in a few minutes by registering online.

Benefits of TIN Certificate

The first advantage of a TIN certificate is that you will be registered as one of the proud taxpayers of the country. The country will run with your income tax.

There are also some other personal benefits of having a TIN such as,

10% tax will be deducted from the income of your deposit in the bank. If TIN is not available, 15% deduction will be made.

To get a bank loan or credit card you need to have a TIN certificate.

At different times the government gives incentives to different professionals or small entrepreneurs. TIN is also required to take advantage of these.

Disadvantages of TIN Certificate

The only downside to TIN Certificate is that, whether you have taxable income or not, you must file a tax return every year.

If you do not submit the return, your income will be treated as black money.

If your taxable income is zero for 3 consecutive years or your annual income does not fall within the tax limit, you should not file a return from the 4th time.

Moreover, you can anaesthetize for the cancellation of your income tax registration.

To learn more about TIN Registration and problems, and find answers to various questions follow our FB page fb.com/eservicesofficial.

I like to print my tax identificaticate number.

ami tin cirtificat apply korte gele nid card alredy exists dekay .akhon ki korbo

আপনি আগে টিন করেছেন

yes

না, আমি নতুন করে করতে চাই

নতুন টিআইএন করতে কি কোন অসুবিধা হচ্ছে?

আমার টিন সার্টিফিকেট করা আছে।কিন্তু লেখা জাপসা।অরিজিনালটা কিভাবে পেতে পারি? ০১৭১২১৩১১৫২

দয়া করে আমাদের ফেসবুক পেইজে যোগাযোগ করুন: https://www.facebook.com/eservicesbdofficial

pls need tin certificate Tex circle 16

Have you already created your TIN? or want to create new TIN?

How to submit eReturn as I have forgotten my password and registered mobile number. The mobile was official and surrendered while leaving my job.

My E tin number is 626539670155

Contact us through our Facebook Messenger