Do you have to pay tax if you have TIN certificate?

Do you have to pay income tax returns and tax ff you have only TIN certificate? Let’s know when you have to file income tax return and tax.

For many purposes, we may need to register Tax Identification Number (TIN). Many people fear that they will have to pay income tax every year if they have registered TIN certificate.

Here I’ll discuss,

- If you have to pay taxes when you have only TIN certificate.

- When you have to file income tax return if you have registered TIN.

- When you must file Tax Return compulsorily.

I hope, this information will help you a lot.

Do You have to Pay Taxes if You have TIN certificate?

No, you don’t have to pay tax if you have TIN certificate. You have to pay income tax only if your annual income exceeds Tk 3 lakh for men and Tk 3 lakh 50 thousand for women and tax is applicable on the income.

You may have questions in mind that you have a TIN certificate but no income to pay income tax. So, do you have to file income tax return or pay income tax? Or how much to pay income tax?

The simple answer is, you have to file income tax return only if you have taxable income and you have to pay tax on the amount that comes as tax on the return.

Suppose you are a male and your annual income is Rs. 5 lakhs. As per Finance Act, 2021 your first Rs 3 lakh is tax free on which no tax is payable. Income tax will be levied at the rate of 5% on the first Rs 1 lakh of the remaining Rs 2 lakh and 10% on the next Rs 1 lakh. Hence the amount of income tax is as follows:

| Income | Tax Rate | Tax Amount |

|---|---|---|

| First 3,00,000 (Tax-free) | 0% | 0 Tk |

| Next 1,00,000 | 5% | 5,000 Tk |

| Next 1,00,000 | 10% | 10,000 Tk |

| Total | 15,000 Tk |

Note that a minimum income tax is payable only if the tax-free income limit is exceeded.

Minimum Income Tax

| Taxpayer of Dhaka and Chittagong City Corporation area | 5,000/- |

| Taxpayer of Other City Corporation area | 4,000/- |

| Taxpayers of areas other than City Corporations | 3,000/- |

That is, if the amount of tax levied as per the income is less than the minimum income tax, you will have to pay the minimum tax.

No tax is payable if the income is exempt from tax

It may be noted that the government provides full or partial tax exemption or rebate on income from certain sources. For example, foreign remittances, government allowances and pensions are fully tax exempted. Again, no tax has to be paid up to the first 20 lakhs of income earned from poultry farms.

Do You have to file Income Tax Return when You have TIN Certificate

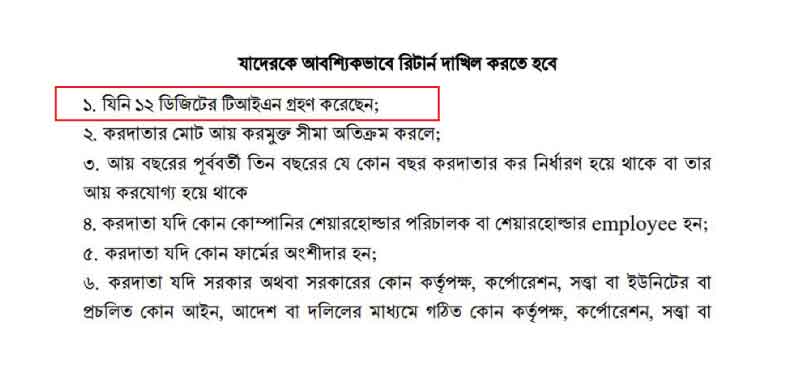

The one word answer to this question is “yes”. According to the Income Tax guidelines for the income year 2021-2022, income tax return should be submitted only if you have a 12-digit TIN certificate (E TIN). That is, for those who will submit the return till November 30, 2022, the income tax return must be submitted only if they have a 12-digit E TIN.

However, this obligation has been removed from the income year 2022-2023. For this see – Income Tax Guidelines 2022-2023.

As per Income Tax Guidelines 2022-2023, you don’t have to file income tax return if you have TIN certificate. Income tax return is required to be filed only if you have taxable income or are in the list of persons who are required to file income tax return compulsorily.

How to File Income Tax e Return Online

Income Tax Return is not Mandatory for only Having TIN Certificate from 2023

The Income Tax Guidelines 2022-2023 clearly states who will file the Income Tax Return. 2 categories of persons required to file income tax returns are a) those who have taxable income and, b) those who are required to file returns compulsorily.

You should always try to know yourself without relying on the words of others. See guidelines and guidelines published by NBR, easy to understand.

Bottom Line

The bottom line is that there is no obligation for you to pay tax or file an income tax return just by having a tin. Only, if you are in the list of those who are required to file returns compulsorily, then you will have to file an income tax return. And the taxation will depend on the source and amount of your income.

If there is still any problem, then please comment by writing your question. I will try to reply to comments within 24 hours.

More Information about Income Tax

| TIN Registration | TIN Certificate Download |

| Lost TIN Certificate | e-TIN Certificate Recovery |

| Category | Income Tax |

| Homepage | Eservicesbd |